AI in financial institutions isn’t some far-off fantasy cooked up by Silicon Valley. It’s already shaping how money moves, how risk is managed, and how decisions get made, quietly and behind the scenes. For CFOs in community banks, that shift is no longer optional. Budgets are tight, regulations are brutal,

pentedge

Banks using AI used to sound like a tech conference buzzword or a wild prediction someone made back in 2010 while sipping stale coffee in a boardroom. Now, it’s plain reality. Small and midsize banks, not just the giants, are leaning into it. But here’s the thing: the benefits they’re

AI is picking up speed inside banks, but governance isn’t keeping pace. That’s the tension Lisa Pent is tackling at the IBANYS Regulatory Compliance Update on February 3rd. Banks are trying to push forward with smarter tools and automation, while examiners are asking sharper questions about ownership, oversight, and monitoring.

In 2026, AI automation options for community banks won’t just be tools on a wishlist, they’ll be the lifelines leaders use to cut through legacy red tape and customer service lags that have haunted the industry for years. From tired back-office workflows to the constant pressure to speed up digital

The Bankadelic 2025 Banksgiving Special is the audio stuffing you didn’t know you needed, packed with smart takes, warm moments, and a roast or two of the financial industry’s biggest turkeys. Thanksgiving traffic is crawling, the gas station coffee is burnt, and you’re stuck listening to a playlist that somehow

AI use cases for community banking are starting to look a lot less like Silicon Valley wishlists and a lot more like real tools solving gritty, local problems. Picture this: a small-town branch in Iowa, a desktop monitor humming behind the teller counter, the smell of fresh coffee wafting from

Use Cases for AI in Community Banking are shifting fast from idea to real-life tools that actually do the work. Picture a small bank in Ohio. The morning sun hits the teller windows, the printer hums, and a branch manager scans the weekly performance report, already wondering how much time

AI use cases for community banking are evolving fast, and they’re not all about cost-cutting or fraud flags. One of the most surprising things is how personal this new tech can feel, especially in small, high-trust markets. Picture a small-town bank in Missouri. The sun’s hitting the brick façade, the

Looking for AI use cases for community banking? You’ve come to the right place. With so much going on and technology constantly advancing it’s easy to get left behind. The real challenge is not the tech though. It’s what you don’t know you don’t know. That’s why we think it’s

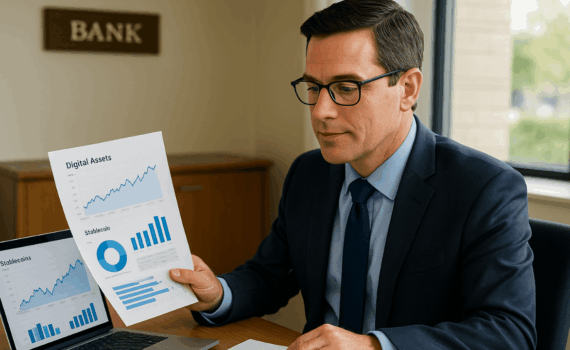

The new GENIUS Act has officially been signed into law. For community banks, this is not just another news story. It is a policy turning point that has been shaped in no small part by the Independent Community Bankers of America, better known as ICBA. With the regulation of payment

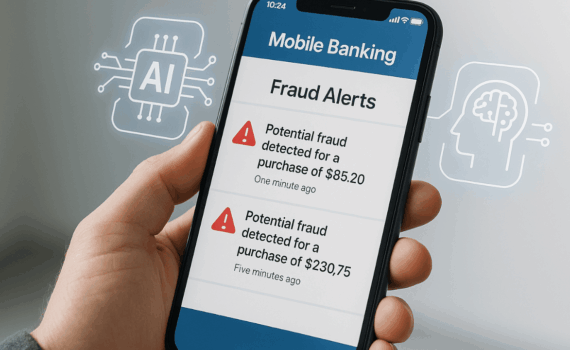

Artificial intelligence in digital banking is changing how community banks show up for their customers. It’s not just about faster apps or slicker websites. It’s reshaping the heart of how banks understand people, handle risk, and build trust in a world that expects everything now. Community banks don’t always have

Advanced AI banking applications are transforming how community banks in the United States operate, serve their customers, and stay competitive. From smarter fraud prevention to ultra-personalized services, artificial intelligence is no longer a futuristic idea. It is a hands-on tool that is working behind the scenes to make decisions faster,