The new GENIUS Act has officially been signed into law. For community banks, this is not just another news story. It is a policy turning point that has been shaped in no small part by the Independent Community Bankers of America, better known as ICBA. With the regulation of payment

community banks

Artificial intelligence in digital banking is changing how community banks show up for their customers. It’s not just about faster apps or slicker websites. It’s reshaping the heart of how banks understand people, handle risk, and build trust in a world that expects everything now. Community banks don’t always have

The Artificial Intelligence Action Plan dropped from the White House this month, and here at PentEdge, we paid close attention. It is not every day that national policy intersects directly with the technology roadmaps we help build for banks and financial institutions. This new federal push could very well reshape

Onboarding and process automation doesn’t sound thrilling at first blush. It sounds… technical. Cold. Maybe even complicated. But here’s the twist: when it’s done right, it becomes one of the most human things your bank can offer. A predictable and clear way to engage with your customers. Because for most

There has been a recent shift away from SaaS into something called “Services-as-Software” which feels way more in tune with the way we want to do business in an increasingly digital world. Community bankers have always faced unique challenges when it comes to balancing legacy systems, customer service, and the

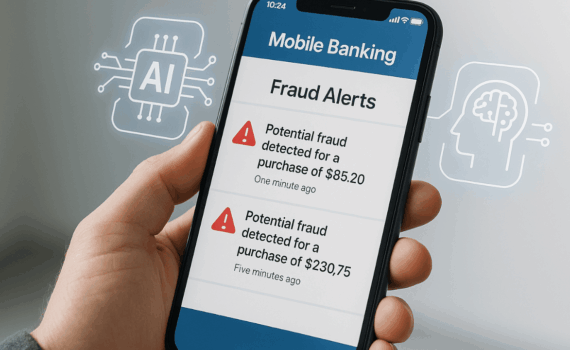

Advanced AI banking applications are transforming how community banks in the United States operate, serve their customers, and stay competitive. From smarter fraud prevention to ultra-personalized services, artificial intelligence is no longer a futuristic idea. It is a hands-on tool that is working behind the scenes to make decisions faster,

AI banking applications are quietly reshaping how banks compete, win customers, and stay ahead. These tools are no longer just ideas on tech slideshows. They’re driving real-time decisions, spotting risks, and opening doors to faster, more personal banking. The race isn’t just about digital anymore. It’s about how smart that

The Adirondack North Country Alliance (ANCA) held its 2025 Annual Meeting last Friday morning, and while there were no cameras flashing, the room was full. People came from across the 14 counties that stretch from Lake Ontario to Lake Champlain, showing just how much energy and focus this region is

The Hyde Collection hosted a 2025 Summer Luncheon that brought more than sunshine to Lake George this week. It lit up the shoreline with the warmth of community, generosity, and shared purpose. For those of us at PentEdge, being part of this memorable event at The Sagamore Resort was more

Data harmonization and reporting dashboards might sound like something you’d hear at a tech conference. But at its core, this is about something much simpler: finally getting all your information to agree with itself. Because when data actually works together, it works harder. And when your teams stop arguing over

Custom middleware and API integrations between legacy systems isn’t exactly something bankers dream about. It sounds like backend plumbing, and honestly, it is. But when you’ve got legacy tech in one corner and modern tools in another, and nothing connecting them, it’s the plumbing that either keeps things flowing or

Core modernization implementation might be the least glamorous phrase in banking. It brings to mind long timelines, even longer RFPs, and meetings with vendors who seem more interested in selling software than solving problems. But here’s the truth: modernizing your bank’s core doesn’t have to feel like buying a rocket