Community banks should lead with AI to stay relevant, competitive, and connected in a rapidly changing financial landscape. That sentence might feel bold. But it captures a truth that’s becoming more urgent by the day. The world of finance is evolving fast. Customer expectations have shifted. Compliance demands are mounting.

artificial intelligence

The GENIUS Act has officially brought stablecoins under federal regulation. That means the future of digital currency is no longer speculative; it is an active policy. For community banks, this is more than just legislation. It is a loud, clear call to upgrade their tech infrastructure. Because while the law

Artificial intelligence in digital banking is changing how community banks show up for their customers. It’s not just about faster apps or slicker websites. It’s reshaping the heart of how banks understand people, handle risk, and build trust in a world that expects everything now. Community banks don’t always have

The Artificial Intelligence Action Plan dropped from the White House this month, and here at PentEdge, we paid close attention. It is not every day that national policy intersects directly with the technology roadmaps we help build for banks and financial institutions. This new federal push could very well reshape

Onboarding and process automation doesn’t sound thrilling at first blush. It sounds… technical. Cold. Maybe even complicated. But here’s the twist: when it’s done right, it becomes one of the most human things your bank can offer. A predictable and clear way to engage with your customers. Because for most

In the world of community bank fintech, progress often feels like a tightrope walk between innovation and compliance, vision and practicality. But every now and then, the right pieces come together to make real transformation possible. That’s exactly what happened when PentEdge forged a groundbreaking partnership with Techjays, Barry N.

Advanced AI banking applications are transforming how community banks in the United States operate, serve their customers, and stay competitive. From smarter fraud prevention to ultra-personalized services, artificial intelligence is no longer a futuristic idea. It is a hands-on tool that is working behind the scenes to make decisions faster,

AI banking applications are quietly reshaping how banks compete, win customers, and stay ahead. These tools are no longer just ideas on tech slideshows. They’re driving real-time decisions, spotting risks, and opening doors to faster, more personal banking. The race isn’t just about digital anymore. It’s about how smart that

The Adirondack North Country Alliance (ANCA) held its 2025 Annual Meeting last Friday morning, and while there were no cameras flashing, the room was full. People came from across the 14 counties that stretch from Lake Ontario to Lake Champlain, showing just how much energy and focus this region is

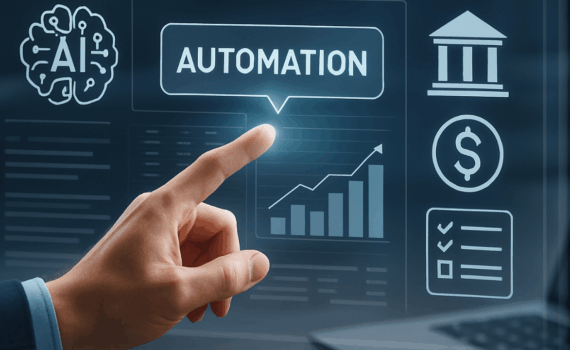

AI technology is changing everything in the banking world. For community banks, the shift is not just about automation. It is about how well change is managed and how carefully technology partners are chosen. Community bankers considering technology partners must now think far beyond software capabilities. They must consider how

The IBANYS Conference brought something deeper than talking points and vendor pitches. It delivered a moment of reflection for community bankers across New York. Leaders sat in sessions filled with product demos and jargon-heavy language, but the real conversations happened in between. They happened over coffee, during hallway chats, and

Custom middleware and API integrations between legacy systems isn’t exactly something bankers dream about. It sounds like backend plumbing, and honestly, it is. But when you’ve got legacy tech in one corner and modern tools in another, and nothing connecting them, it’s the plumbing that either keeps things flowing or