The way banks use AI isn’t about robots taking over jobs or fancy buzzwords on a PowerPoint slide. It’s about real stuff: handling fraud faster, serving customers better, and keeping up with expectations that just won’t sit still. AI solutions for banks aren’t some shiny thing for tomorrow they’re the

artificial intelligence

Corporate treasury used to be a backstage crew role, quietly keeping liquidity flowing and making sure the business could fund its plans. But the rise of AI in banking and finance has dragged treasury into the spotlight, especially when it comes to risk. Suddenly, board members are expected to understand

AI is picking up speed inside banks, but governance isn’t keeping pace. That’s the tension Lisa Pent is tackling at the IBANYS Regulatory Compliance Update on February 3rd. Banks are trying to push forward with smarter tools and automation, while examiners are asking sharper questions about ownership, oversight, and monitoring.

Banking and AI are crashing into each other like rush hour in downtown Atlanta, where everyone’s in motion but few know which lane actually gets you there. Everyone’s talking about transformation, automation, and data-powered decision-making, but behind the scenes, way too many plans stall out before they hit production. That’s

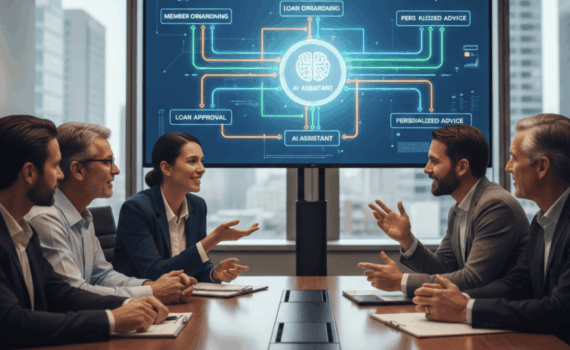

Credit unions are showing rising interest in AI, yet many assume they need fully consolidated data or advanced analytics environments before they can begin. In practice, the earliest wins come from internal workflows that require far less data than expected. Leaders see how AI can strengthen lending review, enhance operational

AI Execution in Mid-Tier Banking is reshaping how regional institutions strengthen workflows, improve decisions, and advance their operational capabilities. Banks in the $10 billion to $250 billion range are already moving through modernization. Many have active AI initiatives in lending efficiency, fraud detection, document intelligence, and operational review. Leaders understand

Old banking cores weren’t built for AI in banking. They weren’t built for real-time anything, honestly. And yet, they’re still the default under the hood of thousands of banks trying to keep up in 2026. The result? Slow rollouts, patchwork integrations, and a whole lot of duct tape holding together

The Sept 25th Adirondack TechTalk event didn’t feel like a typical meetup. It happened in the heart of Saranac Lake, where autumn hits early, the Wi-Fi gets moody, and the entrepreneurs are as gritty as they are curious. People showed up because they needed something that’s rare in rural tech

The buzz in Watkins Glen next week is not just about the fall foliage or the Seneca Lake cruise, it’s about something a little less scenic and a lot more strategic: community banks finding their AI edge. Lisa Pent, CEO and Founder of ThePentEdge.com, is stepping up to the mic

AI use cases for community banking are starting to look a lot less like Silicon Valley wishlists and a lot more like real tools solving gritty, local problems. Picture this: a small-town branch in Iowa, a desktop monitor humming behind the teller counter, the smell of fresh coffee wafting from

AI use cases for community banking are evolving fast, and they’re not all about cost-cutting or fraud flags. One of the most surprising things is how personal this new tech can feel, especially in small, high-trust markets. Picture a small-town bank in Missouri. The sun’s hitting the brick façade, the

Looking for AI use cases for community banking? You’ve come to the right place. With so much going on and technology constantly advancing it’s easy to get left behind. The real challenge is not the tech though. It’s what you don’t know you don’t know. That’s why we think it’s