The way banks use AI isn’t about robots taking over jobs or fancy buzzwords on a PowerPoint slide. It’s about real stuff: handling fraud faster, serving customers better, and keeping up with expectations that just won’t sit still. AI solutions for banks aren’t some shiny thing for tomorrow they’re the

AI in fintech

AI is picking up speed inside banks, but governance isn’t keeping pace. That’s the tension Lisa Pent is tackling at the IBANYS Regulatory Compliance Update on February 3rd. Banks are trying to push forward with smarter tools and automation, while examiners are asking sharper questions about ownership, oversight, and monitoring.

Banking and AI are crashing into each other like rush hour in downtown Atlanta, where everyone’s in motion but few know which lane actually gets you there. Everyone’s talking about transformation, automation, and data-powered decision-making, but behind the scenes, way too many plans stall out before they hit production. That’s

Credit unions are showing rising interest in AI, yet many assume they need fully consolidated data or advanced analytics environments before they can begin. In practice, the earliest wins come from internal workflows that require far less data than expected. Leaders see how AI can strengthen lending review, enhance operational

AI Execution in Mid-Tier Banking is reshaping how regional institutions strengthen workflows, improve decisions, and advance their operational capabilities. Banks in the $10 billion to $250 billion range are already moving through modernization. Many have active AI initiatives in lending efficiency, fraud detection, document intelligence, and operational review. Leaders understand

Old banking cores weren’t built for AI in banking. They weren’t built for real-time anything, honestly. And yet, they’re still the default under the hood of thousands of banks trying to keep up in 2026. The result? Slow rollouts, patchwork integrations, and a whole lot of duct tape holding together

The Bankadelic 2025 Banksgiving Special is the audio stuffing you didn’t know you needed, packed with smart takes, warm moments, and a roast or two of the financial industry’s biggest turkeys. Thanksgiving traffic is crawling, the gas station coffee is burnt, and you’re stuck listening to a playlist that somehow

Nobody running a community bank is sitting around with time to spare, but the WomenExecs on Boards Symposium still came up more than once this fall. Tucked into the September calendar, it didn’t shout. It didn’t need to. People who care about the future of leadership and governance were already

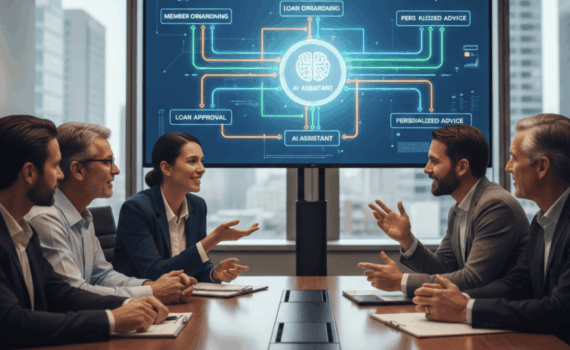

Use Cases for AI in Community Banking are shifting fast from idea to real-life tools that actually do the work. Picture a small bank in Ohio. The morning sun hits the teller windows, the printer hums, and a branch manager scans the weekly performance report, already wondering how much time

Looking for AI use cases for community banking? You’ve come to the right place. With so much going on and technology constantly advancing it’s easy to get left behind. The real challenge is not the tech though. It’s what you don’t know you don’t know. That’s why we think it’s

FinovateFall in New York City isn’t a quiet conference. It hums. You hear the buzz walking past badge check, through the clusters of espresso-fueled product leads, and into the demo hall where fintech startups try to win hearts in just seven minutes. Innovation on stage. Strategy in the aisles. And

We’re at FinovateFall this week (Click here to find out more) in New York City, and it’s already shaping up to be one of the most relevant fintech gatherings of the year. From early-stage demos to serious conversations about infrastructure, it’s exactly the kind of space where our team thrives.