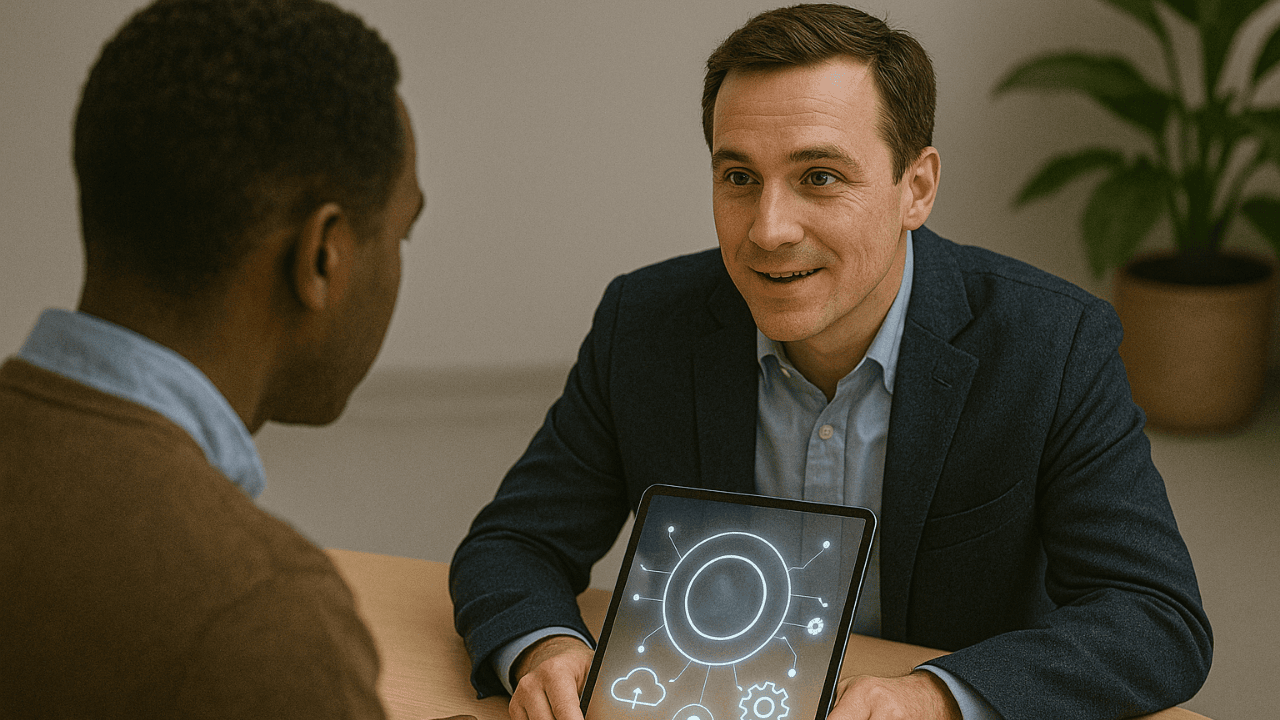

AI technology is changing everything in the banking world. For community banks, the shift is not just about automation. It...

AI & Tech Implementation Partner

Predictive Analytics Partner

Regulatory & Risk Advisor

Operations & Accounting Advisor

Digital Transformation Partner

AI technology is changing everything in the banking world. For community banks, the shift is not just about automation. It...

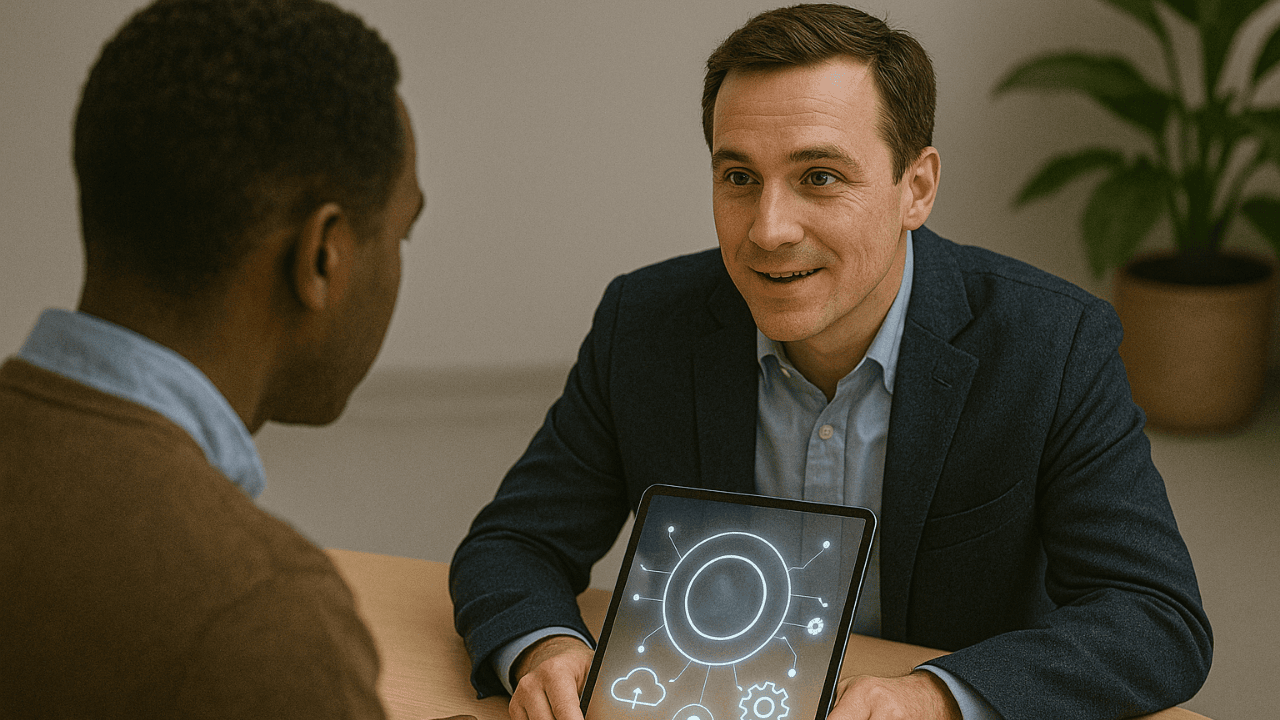

The IBANYS Conference brought something deeper than talking points and vendor pitches. It delivered a moment of reflection for community...

The Hyde Collection hosted a 2025 Summer Luncheon that brought more than sunshine to Lake George this week. It lit...