Every member of community bank leadership is searching for an AI use case in banking worth bringing to the board, but most folks don’t know what’s real and what’s just buzz. Especially in lending. There’s a lot of noise about automation and personalization, but very little about what actually helps

Thought Leadership

AI in financial institutions isn’t some far-off fantasy cooked up by Silicon Valley. It’s already shaping how money moves, how risk is managed, and how decisions get made, quietly and behind the scenes. For CFOs in community banks, that shift is no longer optional. Budgets are tight, regulations are brutal,

The way banks use AI isn’t about robots taking over jobs or fancy buzzwords on a PowerPoint slide. It’s about real stuff: handling fraud faster, serving customers better, and keeping up with expectations that just won’t sit still. AI solutions for banks aren’t some shiny thing for tomorrow they’re the

Corporate treasury used to be a backstage crew role, quietly keeping liquidity flowing and making sure the business could fund its plans. But the rise of AI in banking and finance has dragged treasury into the spotlight, especially when it comes to risk. Suddenly, board members are expected to understand

Banks using AI used to sound like a tech conference buzzword or a wild prediction someone made back in 2010 while sipping stale coffee in a boardroom. Now, it’s plain reality. Small and midsize banks, not just the giants, are leaning into it. But here’s the thing: the benefits they’re

In 2026, AI automation options for community banks won’t just be tools on a wishlist, they’ll be the lifelines leaders use to cut through legacy red tape and customer service lags that have haunted the industry for years. From tired back-office workflows to the constant pressure to speed up digital

Credit unions are showing rising interest in AI, yet many assume they need fully consolidated data or advanced analytics environments before they can begin. In practice, the earliest wins come from internal workflows that require far less data than expected. Leaders see how AI can strengthen lending review, enhance operational

AI Execution in Mid-Tier Banking is reshaping how regional institutions strengthen workflows, improve decisions, and advance their operational capabilities. Banks in the $10 billion to $250 billion range are already moving through modernization. Many have active AI initiatives in lending efficiency, fraud detection, document intelligence, and operational review. Leaders understand

Old banking cores weren’t built for AI in banking. They weren’t built for real-time anything, honestly. And yet, they’re still the default under the hood of thousands of banks trying to keep up in 2026. The result? Slow rollouts, patchwork integrations, and a whole lot of duct tape holding together

The Bankadelic 2025 Banksgiving Special is the audio stuffing you didn’t know you needed, packed with smart takes, warm moments, and a roast or two of the financial industry’s biggest turkeys. Thanksgiving traffic is crawling, the gas station coffee is burnt, and you’re stuck listening to a playlist that somehow

Community banks should lead with AI to stay relevant, competitive, and connected in a rapidly changing financial landscape. That sentence might feel bold. But it captures a truth that’s becoming more urgent by the day. The world of finance is evolving fast. Customer expectations have shifted. Compliance demands are mounting.

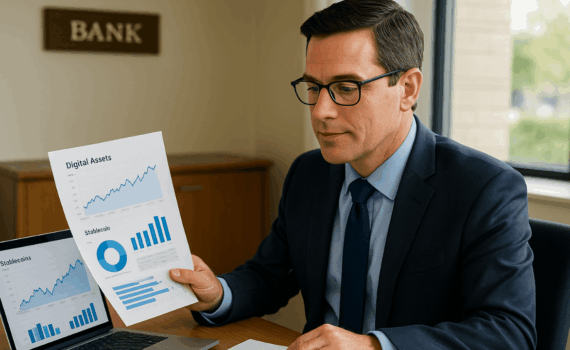

The new GENIUS Act has officially been signed into law. For community banks, this is not just another news story. It is a policy turning point that has been shaped in no small part by the Independent Community Bankers of America, better known as ICBA. With the regulation of payment