AI use cases for community banking are evolving fast, and they’re not all about cost-cutting or fraud flags. One of the most surprising things is how personal this new tech can feel, especially in small, high-trust markets.

Picture a small-town bank in Missouri. The sun’s hitting the brick façade, the drive-through teller lane is slow and familiar, and inside, someone just deposited a birthday check with a handwritten note. Now imagine that same bank using AI to remember not just the customer’s name but their financial rhythm, their seasonal needs, their quirks.

That’s not some future concept. It’s the kind of thing already happening, and it’s showing up in ways that make sense for banks that still know the names of the kids in the back seat.

TL;DR: How AI Is Redefining Local Banking

- What AI actually solves for community banks right now

- The new frontline: smarter service that still feels human

- Fraud detection that learns in real time

- Credit decisioning that moves faster without cutting corners

- How AI helps with compliance without killing the budget

- One platform pulling it together without wrecking your stack

- What matters most and how to move forward

Keeping That Human Touch While Getting Smarter

Most AI talk starts with efficiency. That’s fine if you’re running a megabank. Community banks work differently. The relationships are closer. The risk tolerance is personal.

AI can help here by reducing noise, not replacing people. In customer service, that means AI tools that listen in on live calls and suggest helpful next steps in real time. A teller hears “I’m calling about my mortgage,” and AI pulls up the exact loan details before the caller finishes. It’s not a script. It’s smart triage.

Another spot where this shows up is in digital conversations. Fuse, a customer intelligence platform by PentEdge, has a feature where AI helps bankers see a full client profile during live chats or emails. Not just balance data, but trends. Payment gaps. Engagement patterns. One banker called it “memory for the whole team.”

Small banks often rely on personal memory to build loyalty. That works, until someone goes on vacation or retires. AI turns what used to be siloed knowledge into accessible insight. Everyone sounds like they know the customer, because they do.

People still make the calls. AI just makes those calls sharper.

Watching for Trouble Without Losing Sleep

Fraud used to mean odd charges in far-off states. Now it can be a social engineering call, a hijacked login, or a hacked device sitting quietly inside your firewall.

Community banks get targeted because attackers assume less robust systems. AI flips that assumption. With tools that model behavior in real time, banks can flag unusual activity instantly, not just after the fact.

For example, if a customer who always transfers funds on the third of the month suddenly moves double the amount on a weekend night from a new device, that can trigger review. Not lockout. Just pause and verify.

Some tools, like those used by Fuse, cross-check data from multiple channels. If the phone number in a support chat doesn’t match the one on file, or if the tone of the message doesn’t sound like the usual user, AI catches the drift. It flags it.

The strength here isn’t just in detection. It’s in context. AI can compare this one moment to a full history. That’s where false positives drop, and real fraud gets spotted faster.

It’s quiet protection. Most customers never know it’s there.

Better Lending Decisions Without the Red Tape

Speed matters in lending, but in a small bank, you can’t afford bad calls. Community banks are built on careful risk decisions that keep reputations strong. AI can support that without turning underwriting into a black box.

What’s different now is transparency. Some AI tools break down exactly why a borrower is a risk match or mismatch. It’s not just a score. It’s a map of the decision. That helps loan officers explain outcomes to customers in plain terms.

Fuse includes a feature that tracks historic lending behavior patterns, which lets underwriters spot trends across business types or seasonal income swings. So if a farm equipment supplier in Iowa shows low cash flow in February, that doesn’t kill their chances. The AI shows this is common, expected, and offset by March surges.

One community bank used this kind of insight to rethink small business loan windows. They widened their approval range by 14 percent without increasing default rates. That’s not a fluke. That’s pattern visibility.

And speed follows clarity. AI pre-checks inputs and structures applications so human decision makers can step in at the right point. Not too soon. Not too late.

Staying Compliant Without Growing Your Headcount

Compliance pressure isn’t new, but the speed and complexity of today’s regulatory environment is. For a community bank with a lean ops team, this can eat time fast.

AI now helps banks track new guidance, map it to current practices, and flag gaps. Fuse integrates this into everyday workflows. A new rule about customer disclosures? The system checks what’s missing across templates and touchpoints.

One bank caught a disclosure omission on over 200 outbound emails. Fixed it in a day.

More than that, AI can now analyze language in outreach materials, flagging anything that might raise scrutiny. Think of it like a second pair of eyes on everything you send, not just loan docs.

It’s also worth noting that audit prep changes with AI on your side. Instead of pulling data manually or hoping the right report covers the right period, these systems can generate tailored logs on demand.

No panic the week before. Just clean trails.

One Brain Instead of Five Different Apps

One problem with AI in banking is how fragmented it gets. A tool for calls. Another for fraud. Another for marketing. Then a compliance add-on.

Fuse works differently by tying all of those into one shared system. Customer profiles update across departments. Risk flags connect with service touchpoints. AI doesn’t just guess. It sees.

Here’s the difference: if a customer calls about a missing deposit and also triggers a fraud flag that same week, the AI links those two events. That keeps the banker informed.

Or if a business client drops off on email engagement, AI might flag them for check-in, before the relationship fades. That’s not marketing fluff. That’s retention.

The platform isn’t locked to one workflow. It adapts to whatever systems the bank already uses. Which means you don’t need to rip out what works. You just make it smarter.

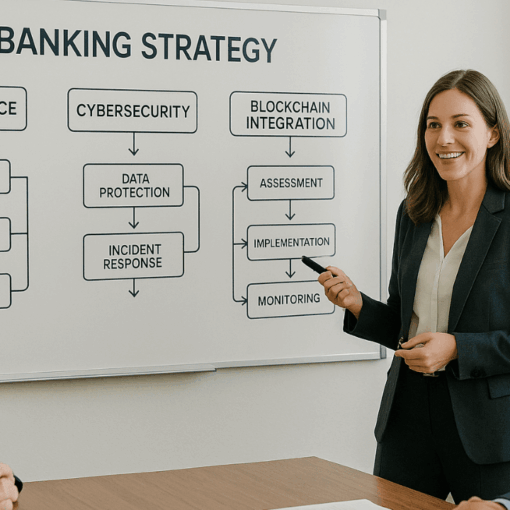

Here’s a snapshot of where AI sits across departments in a community bank using a unified platform like Fuse:

| Department | AI Touchpoint | Outcome |

| Customer Service | Real-time insight during calls and chats | Faster help, deeper context |

| Risk | Behavior modeling and event flagging | Early fraud detection |

| Lending | Pattern-based decision support | Smarter approvals, more transparency |

| Compliance | Document and language analysis | Fewer misses, faster fixes |

| Marketing | Engagement pattern tracking | Better timing, reduced churn |

It all ties back to one goal: treat customers like people, not puzzles.

The Part Worth Highlighting Twice

AI use cases for community banking don’t have to be huge, expensive, or futuristic. They’re working now, in small branches with three-person teams and long-time customers who still send paper checks.

The difference isn’t in the tech alone. It’s in how it fits the culture of a local bank. Trust, memory, rhythm. That’s where AI shines when it’s done right.

Contact Us if you’re ready to make your bank smarter without losing what makes it special.

Some Things That Should Stick

- AI is helping community banks remember better, act faster, and see further

- Fraud detection is shifting from reaction to prevention in real time

- Credit decisions are becoming clearer and more explainable

- Compliance support is now proactive and scalable

- Fuse connects departments so nothing gets lost between systems

Contact Us to see how it fits your bank.