There has been a recent shift away from SaaS into something called “Services-as-Software” which feels way more in tune with the way we want to do business in an increasingly digital world.

Community bankers have always faced unique challenges when it comes to balancing legacy systems, customer service, and the pressure to innovate. The newest disruptor knocking on your vault door is something called Services-as-Software, or SaS for short. This concept, recently defined by HFS Research, represents a $1.5 trillion shift in how businesses deliver and consume services. And yes, it matters deeply to community banking.

So what is Services-as-Software? And more importantly, what does it mean for you, your institution, and your future?

This article is your shortcut through the noise. We’ve sifted through the research, watched the webinars, and combed the transcripts. Here’s the real-world, no-nonsense breakdown tailored for community banks.

TL;DR: What You Need to Know About Services-as-Software

- Services-as-Software (SaS) is not just tech jargon. It’s the next big shift in how services are delivered and monetized.

- AI and automation are pushing banks to move beyond traditional service models.

- Legacy contracts and outdated systems are becoming liabilities.

- The new game is all about outcomes, not effort.

- Pricing models are shifting from time-based billing to pay-per-outcome or consumption.

- Community banks need to get serious about investing in young talent and modern workflows to survive this transformation.

- The institutions that thrive will master the balance between people, products, and partners.

SaS: A Buzzword or a Business Model Earthquake?

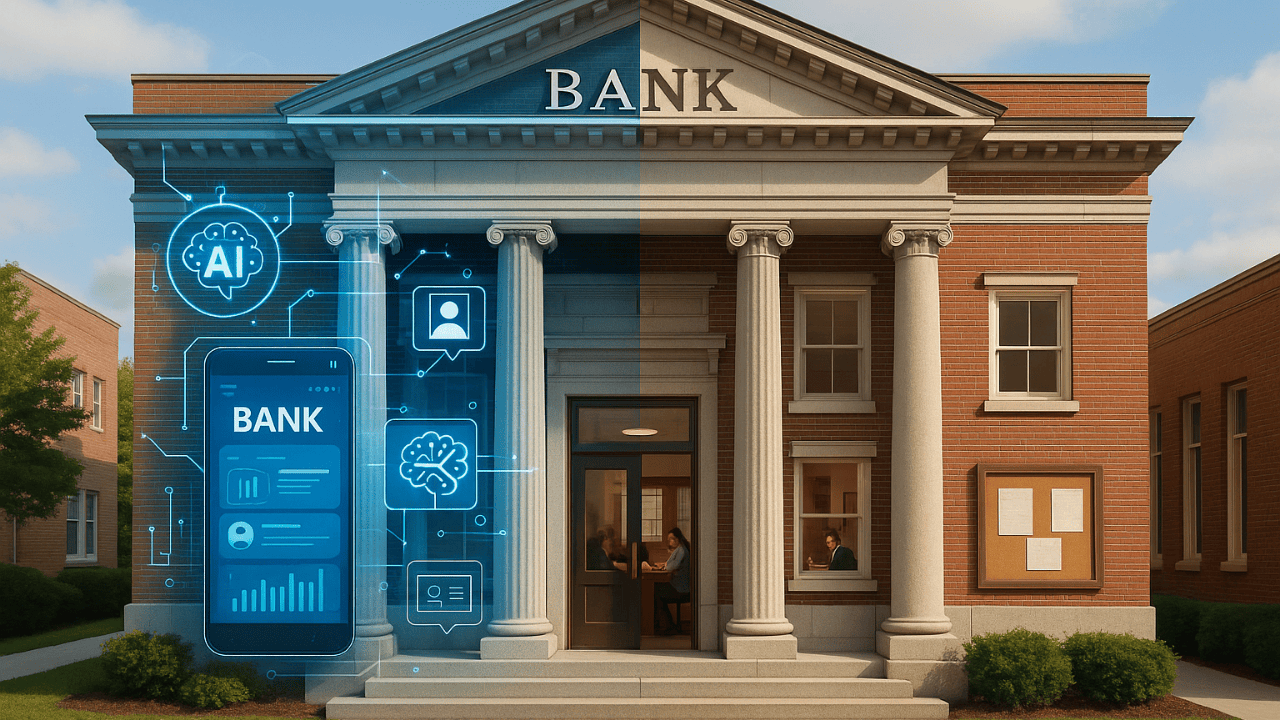

Community banking has always been about relationships, trust, and reliability. But what if the very way banks deliver services is about to change, not incrementally, but fundamentally?

Services-as-Software flips the traditional model on its head. Instead of services being labor-intensive or bound to rigid software platforms, they are now being transformed into productized, AI-driven solutions that work autonomously and adaptively inside your operations. Think of it as smart software that does the job a whole department used to handle.

This isn’t a futuristic concept. It’s happening right now. The big guys like Salesforce, SAP, and ServiceNow are already building outcome-based solutions that blend software and service into seamless experiences. On the flip side, services firms like Accenture and IBM are reshaping their offerings into repeatable, AI-enabled products.

Why This Hits Community Banks Where It Hurts

Community banks have long struggled with tech debt. That term might sound abstract, but it’s painfully real. It’s the cost of maintaining outdated systems that should have been replaced years ago. Most IT spending in the past two decades hasn’t reduced this burden. In fact, it’s only made it worse by wrapping more services around old systems instead of replacing them.

According to HFS Research, over 60 percent of the global IT services market still revolves around maintaining this tech debt. And this creates a dangerous cycle for community banks. You’re paying more for services that deliver less value over time, all while being left behind in the digital arms race.

SaS provides an exit ramp from this cycle.

Imagine replacing your outdated back-office functions with intelligent platforms that handle compliance, onboarding, and lending workflows automatically. Instead of buying another year of system maintenance, you could pay for what actually works: outcomes.

Why Process, Not Tech, Is the Problem

Here’s a wake-up call from the data: only 16 percent of organizations cite outdated technology as their biggest barrier to success. A full 35 percent say their real problem is poor processes. That means banks aren’t struggling because their systems are too old, but because their workflows are inefficient, misaligned, or just plain broken.

This is good news if you’re willing to change. Fixing processes is something within your control, and SaS can help accelerate that. With intelligent platforms, you can redesign workflows around automation and real-time decision-making. That means fewer bottlenecks, better compliance tracking, and faster service delivery.

But here’s the catch. You can’t just plug in a new tool and hope it fixes everything. You need to build new processes around these tools. That’s where many institutions fall short.

AI Is Coming Whether You’re Ready or Not

If geopolitical tension and rising tariffs seem like global issues that don’t touch community banks, think again. These pressures are accelerating investment in AI and automation everywhere. Over half of enterprises are already ramping up their use of AI tools to reduce dependency on traditional labor and outsourcing models.

And while AI can feel intimidating, especially for smaller institutions, it’s not about replacing your team. It’s about enhancing them. Banks that lean into AI are already building internal training programs and deploying private AI models to streamline operations.

Your peers are not just experimenting anymore. They’re embedding AI into core decision-making processes. If you’re still stuck in pilot mode, you’re falling behind.

Pricing Is Getting Smarter Too

Remember how professional services used to be billed by the hour or by full-time equivalent (FTE)? That model is crumbling fast. As more vendors codify their services into products, pricing is moving to a consumption or subscription basis.

Banks no longer want complicated, surprise-ridden invoices. They want to know what they’re paying for and what they’ll get. This means simplified pricing models that align with actual business value. Predictability, transparency, and shared risk are the new expectations.

For community banks, this could mean budgeting differently. You’ll need to think in terms of what services produce, not how much they cost per hour. It also means contracts will start looking more like software agreements, where value is tied to measurable results.

Young Talent Isn’t Optional, It’s Vital

The rise of SaS isn’t just about technology. It’s about culture. Community banks risk losing their identity if they chase efficiency without reinvesting in the people who define their mission.

The temptation to replace entry-level roles with AI might feel efficient in the short term. But long-term success depends on developing talent that understands how to blend human intuition with digital tools. A bank without fresh thinking and innovation becomes irrelevant fast.

That means hiring and training recent graduates. It means building pathways for young professionals to shape your bank’s future. And it means resisting the urge to let automation hollow out your institution.

So Where Should Community Banks Start?

Here’s what HFS recommends, and it’s sound advice:

- People: Build hybrid operating models that blend AI and human judgment. Train your teams continuously. Create career paths for digital-savvy staff.

- Products: Codify your internal expertise into tools that others can use. Turn knowledge into reusable, efficient solutions. Develop platforms that serve both staff and customers intelligently.

- Partners: Work with vendors who understand your vertical. The best partnerships now look more like ecosystems than vendor-client relationships. They must offer plug-and-play integration, deep process knowledge, and the flexibility to evolve with your needs.

The question is not whether to adopt SaS principles. It’s how fast can you adapt without losing what makes your institution special?

So, Is This the End of Traditional Banking Services?

No, but it is the beginning of the end for how those services are currently delivered.

Traditional services will not disappear, but they will be increasingly judged by how adaptable, intelligent, and outcome-focused they are. Customers don’t care about your internal processes. They care about speed, accuracy, and personalization. SaS is how banks deliver that in today’s economy.

This is your opportunity to transform, not react.

Key Takeaways

- Services-as-Software is a $1.5 trillion shift that changes how services are designed, priced, and delivered.

- Community banks stuck in legacy systems are especially vulnerable, but also stand to benefit the most.

- AI, automation, and smarter pricing models are becoming mandatory to stay competitive.

- Investing in young talent is not just good ethics, it’s good business.

- The future of banking is not just digital. It’s productized, intelligent, and deeply integrated into every part of the customer experience.

Ready to explore how Services-as-Software could future-proof your bank?

Contact Us and we’ll help you map out a practical plan for transitioning toward outcome-based services built for the modern era.