The GENIUS Act has officially brought stablecoins under federal regulation. That means the future of digital currency is no longer speculative; it is an active policy. For community banks, this is more than just legislation. It is a loud, clear call to upgrade their tech infrastructure. Because while the law defines how stablecoins can operate, the real question is: can your bank’s systems keep up?

Community banks have always been built on trust and strong relationships. But in the era of instant digital payments, tokenized assets, and blockchain settlement, trust must now be paired with tech. To compete in this fast-changing financial landscape, community banks will need more than compliance. They will need capability.

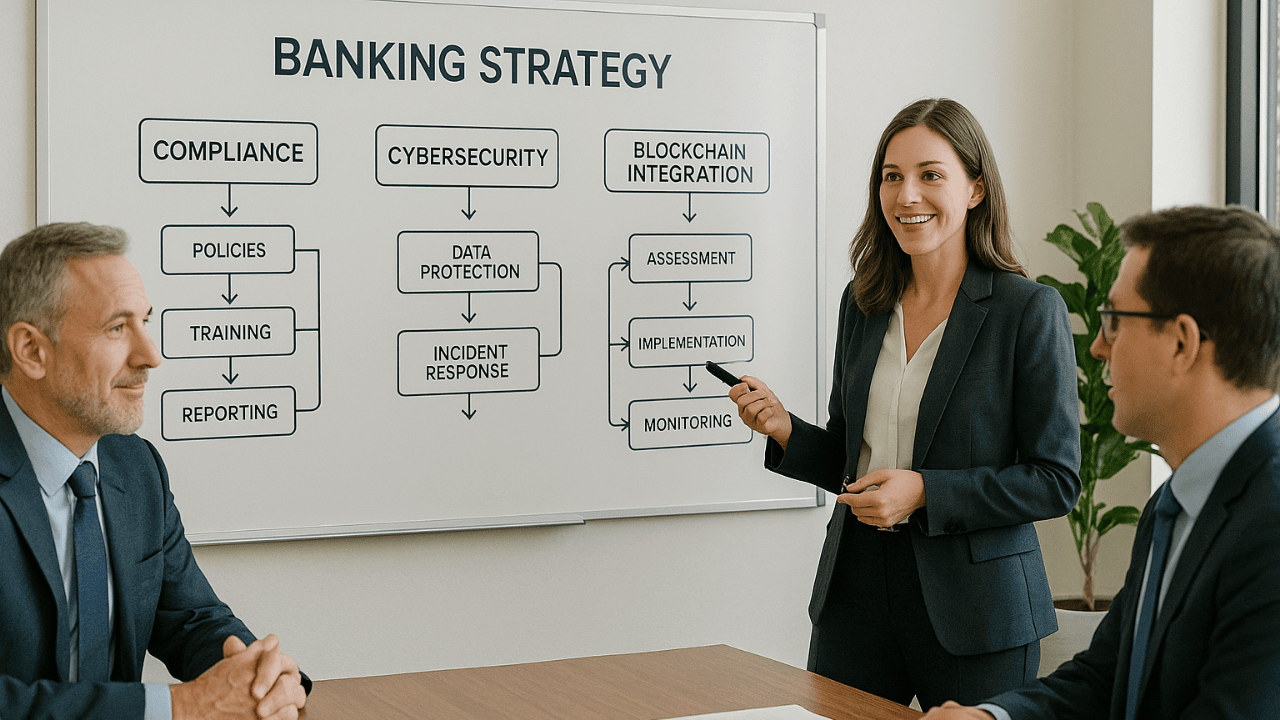

TL;DR: What Community Banks Must Know About the GENIUS Act and Technology

- The GENIUS Act now regulates stablecoins at the federal level.

- This creates a demand for real-time transaction processing across all payment rails.

- Tokenization and custody solutions will be essential for banks entering the digital asset space.

- Compliance tools must evolve to handle instant reporting and real-time audits.

- Cybersecurity and digital identity verification will be foundational, not optional.

- Blockchain integration and fintech partnerships are now a core part of digital strategy.

- ICBA is pushing forward on education, advocacy, and innovation to support banks in this shift.

The Digital Shift Is Real. Now It’s Law.

With over $250 billion in stablecoins already circulating, the GENIUS Act forces the hand of financial institutions to modernize. This is no longer about what might happen. It is happening now. And because the law allows insured depository institutions to issue stablecoins, the door is open for community banks to play a real role in this next era of finance.

But that role depends entirely on whether your systems can support what’s required.

Stablecoins settle in seconds. They operate on blockchains that don’t close for weekends or holidays. They demand transparency of reserves, regulatory compliance, and secure custody. And all of that only works if the tech behind the bank is prepared.

Real-Time Transaction Capabilities Are the New Standard

Most community banks still rely on legacy core systems that process in batches. That is a problem when your competition can clear a transaction in real time on a blockchain ledger. Real-time settlement is no longer a luxury. It is becoming the expectation.

Whether issuing stablecoins or just staying interoperable with new payment networks, banks must shift toward systems that can handle 24/7 real-time processing. That means either modernizing legacy infrastructure or integrating middleware that bridges the old with the new.

Tokenization and Custody Solutions Must Be Built In

If a community bank wants to participate in the stablecoin ecosystem, it needs to be able to tokenize assets securely. That means taking traditional US dollar deposits and converting them into blockchain-based representations. But tokenization alone is not enough.

There must also be secure custody. That includes protecting the tokenized reserves, managing private keys, and ensuring access controls meet the highest standards. Banks will either need to build this capability or partner with fintechs that already specialize in secure digital custody.

Compliance Tools Need to Be API-Ready and Audit-Proof

The GENIUS Act places heavy emphasis on transparency. Issuers must maintain one-to-one reserves and prove it at all times. Regulators will expect real-time access to data. Audits will no longer be a quarterly or annual event; they will be continuous.

To manage that, banks need compliance systems that are API-driven, integrated with blockchain data, and capable of generating live reports. This is a major shift from traditional back-office compliance that relies on manual processes and outdated software.

Cybersecurity and Digital ID Will Become Non-Negotiable

As banks get closer to the digital asset ecosystem, they also become a bigger target. Phishing attacks, token theft, smart contract manipulation, and identity fraud are real risks. Stablecoin transactions are irreversible. Once a token is gone, it is gone.

That makes identity verification and cybersecurity front-line issues. Banks will need digital ID systems, biometric login capabilities, advanced fraud detection, and layered security protocols. Protecting customer accounts in a digital world takes a different approach than protecting checking accounts from overdraft fees.

Blockchain Access Must Be Seamless and Secure

Even if a bank does not plan to issue stablecoins, many of its customers will use them. That means banks need the ability to interface with public and private blockchains to verify balances, monitor transaction flows, and ensure compliance with existing financial regulations.

This will require blockchain middleware platforms or partnerships with fintech firms who can act as interpreters between traditional banking systems and decentralized financial networks.

The goal is not to be a crypto bank. The goal is to remain relevant in a financial system that is rapidly digitizing.

Smart Fintech Partnerships Will Separate Leaders from Followers

Very few community banks can or should build this tech on their own. The smarter path is through partnerships with fintechs who already understand blockchain, compliance, tokenization, and digital payments.

But not every fintech is equal. Banks will need to vet partners for security, regulatory readiness, alignment with bank values, and long-term scalability. The right partnership can unlock competitive advantages. The wrong one can expose your bank to unnecessary risk.

ICBA is already leading efforts to help community banks find and evaluate these partners, while also shaping the regulatory frameworks to ensure fairness and access for smaller institutions.

What Happens Next? Time and Policy Are Moving Fast

The GENIUS Act becomes enforceable either 18 months from signing or 120 days after regulators publish final implementation rules. That means time is short.

ICBA is working to guide the regulatory process, develop education for banks, and ensure that community institutions are not left behind. But action needs to start now. The banks that begin preparing today will be in position to thrive. Those who wait may find themselves struggling to catch up.

Key Takeaways

- Stablecoins are now federally regulated through the GENIUS Act, requiring banks to prepare technologically.

- Real-time transaction processing, tokenization, and blockchain access are now key components of digital banking.

- Compliance tools must evolve to offer live audit support, reserve transparency, and AML capabilities.

- Digital identity and cybersecurity infrastructure will need to scale to meet new risks.

- Strategic fintech partnerships will define how quickly and safely a community bank can enter the digital asset space.

This is the beginning of a new chapter for community banking. The rules have changed. The rails have changed. The tools must change too. If your bank is ready to explore the tech upgrades needed to stay competitive under the GENIUS Act, Contact Us. We can help assess where you are, where you need to go, and how to move forward with confidence.