The topic of AI in fintech is buzzing in financial circles right now, especially among community banks. You might wonder if all the noise around artificial intelligence is just hype, or if it could genuinely help smaller local banks thrive. It’s easy to get swept up by flashy fintech startups, but does your community bank actually need AI-driven technology, or is traditional banking software enough?

Before diving deeper, let’s quickly outline what’s coming up:

TL;DR: What We’re Covering Today:

- How community banks differ from big financial institutions

- What exactly AI in fintech means for smaller banks

- Real benefits of AI tailored specifically to community banking

- Common myths about AI in fintech and the truth behind them

- Ways AI can directly improve customer relationships and profits

- How to choose the right AI tools for your bank’s unique needs

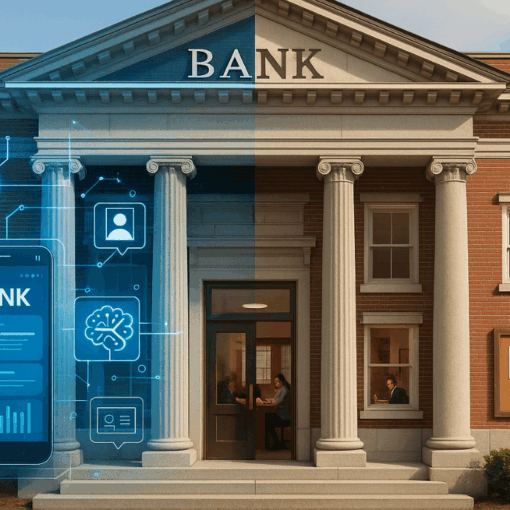

What’s So Different About Community Banks, Anyway?

Big banks have big budgets, there’s no denying it. They often roll out tools and tech, simply because they have massive resources. But community banks play a different game entirely. Your bank probably serves a smaller group of customers who rely on personalized service. AI in fintech for community banks must complement that personalized, relationship-focused banking style, not replace it.

The key is finding AI-driven fintech that matches your community bank’s goals, like improving customer relationships and making banking simpler. Without a targeted approach, adopting fintech is a bit like throwing spaghetti against a wall, sure, something might stick, but it’s messy and far from ideal.

What Does AI in Fintech Really Mean for Community Banks?

When you hear “AI in fintech,” you might imagine robots and futuristic technology taking over banking jobs. Thankfully, that’s not what’s happening here. AI, short for artificial intelligence, in fintech simply means using smart computer systems to make banking smoother, safer, and more efficient.

For community banks, AI fintech isn’t just fancy technology. Instead, it’s practical solutions that automate tedious tasks, provide smarter lending decisions, detect fraud early, and help bank managers better understand their customers. Think of it as your assistant who never sleeps, carefully keeping an eye on everything.

Real Benefits of AI for Your Community Bank

Here’s where AI shines for community banks. Traditional fintech often offers a one-size-fits-all package. AI-driven fintech solutions, however, adapt to your specific banking needs and customer demands. These smart tools analyze data, learn customer behaviors, and provide insights that regular software just can’t match.

Imagine quickly identifying loan risks or uncovering unusual account activities instantly. This targeted approach helps you spend less time chasing down problems and more time providing exceptional service that keeps your customers loyal.

One of the biggest wins? AI fintech allows your bank to compete effectively with bigger players without losing the personal touch customers love. It’s a win-win for your bank and your customers alike.

Busting Myths About AI in Fintech

There are common misconceptions about AI technology for smaller banks. Many community banks believe:

- AI is too expensive.

- AI technology is too complicated.

- Customers don’t trust automated systems.

The reality? Tailored AI fintech solutions are becoming more affordable, easy to use, and customers increasingly appreciate smoother, faster service. Community banks implementing these solutions see genuine value, not just tech-driven hype.

How Exactly Does AI Help Strengthen Customer Relationships?

Your customers trust you. They choose your bank because of the personalized care they receive. Can AI actually strengthen these bonds? Absolutely.

AI-driven fintech identifies patterns and predicts your customers’ financial needs proactively. If your system notices a customer frequently overdrafts, you can gently step in to provide financial counseling or suggest budgeting tools. Or, when it detects customers ready for loan upgrades or refinancing opportunities, your bank can reach out personally. That’s how AI fintech complements your core strength, personalized service, making each customer interaction feel tailored, timely, and thoughtful.

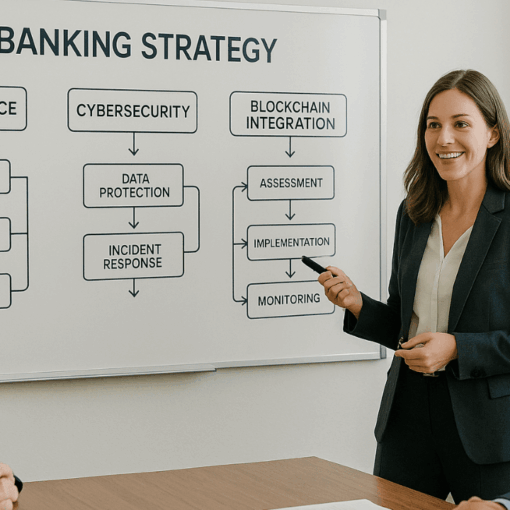

Choosing the Right AI Fintech Solution for Your Bank’s Needs

Not every AI solution fits your community bank perfectly. To find the ideal fit, consider your specific pain points. Do you need help preventing fraud, enhancing loan processing, improving customer service, or maybe all three?

Look carefully at AI fintech vendors, asking tough questions about integration, data security, ease of use, and costs. It’s also smart to consider future scalability. Your chosen AI fintech tool should not only address today’s challenges but also grow with your bank.

Still not sure? That’s understandable. The world of fintech is crowded, and choosing the right AI tools can feel overwhelming. But remember, your goal isn’t simply adopting technology; it’s enhancing your bank’s strengths and protecting your customers’ interests.

Ready to Explore AI in Fintech at Your Community Bank?

Community banks need more than another off-the-shelf fintech solution. AI fintech, tailored specifically for smaller banks, is the smarter path forward. It enhances customer relationships, improves decision-making, reduces risks, and boosts efficiency, all without sacrificing the personal touch your customers love.

For more details or assistance implementing AI fintech specifically crafted for your community bank’s success, don’t hesitate to Contact Us. We’re here to help you make the most of AI in fintech and keep your bank thriving