In 2026, AI automation options for community banks won’t just be tools on a wishlist, they’ll be the lifelines leaders use to cut through legacy red tape and customer service lags that have haunted the industry for years. From tired back-office workflows to the constant pressure to speed up digital

Yearly Archives: 2025

Banking and AI are crashing into each other like rush hour in downtown Atlanta, where everyone’s in motion but few know which lane actually gets you there. Everyone’s talking about transformation, automation, and data-powered decision-making, but behind the scenes, way too many plans stall out before they hit production. That’s

Credit unions are showing rising interest in AI, yet many assume they need fully consolidated data or advanced analytics environments before they can begin. In practice, the earliest wins come from internal workflows that require far less data than expected. Leaders see how AI can strengthen lending review, enhance operational

AI Execution in Mid-Tier Banking is reshaping how regional institutions strengthen workflows, improve decisions, and advance their operational capabilities. Banks in the $10 billion to $250 billion range are already moving through modernization. Many have active AI initiatives in lending efficiency, fraud detection, document intelligence, and operational review. Leaders understand

Old banking cores weren’t built for AI in banking. They weren’t built for real-time anything, honestly. And yet, they’re still the default under the hood of thousands of banks trying to keep up in 2026. The result? Slow rollouts, patchwork integrations, and a whole lot of duct tape holding together

The Bankadelic 2025 Banksgiving Special is the audio stuffing you didn’t know you needed, packed with smart takes, warm moments, and a roast or two of the financial industry’s biggest turkeys. Thanksgiving traffic is crawling, the gas station coffee is burnt, and you’re stuck listening to a playlist that somehow

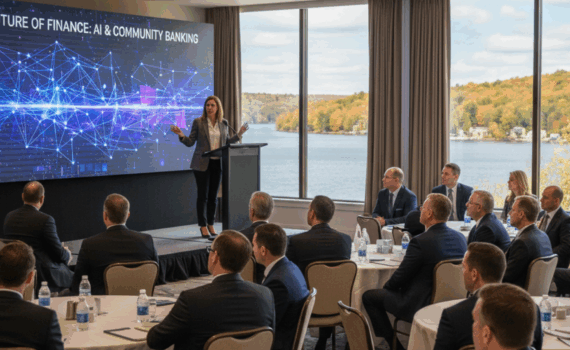

The Sept 25th Adirondack TechTalk event didn’t feel like a typical meetup. It happened in the heart of Saranac Lake, where autumn hits early, the Wi-Fi gets moody, and the entrepreneurs are as gritty as they are curious. People showed up because they needed something that’s rare in rural tech

The buzz in Watkins Glen next week is not just about the fall foliage or the Seneca Lake cruise, it’s about something a little less scenic and a lot more strategic: community banks finding their AI edge. Lisa Pent, CEO and Founder of ThePentEdge.com, is stepping up to the mic

Nobody running a community bank is sitting around with time to spare, but the WomenExecs on Boards Symposium still came up more than once this fall. Tucked into the September calendar, it didn’t shout. It didn’t need to. People who care about the future of leadership and governance were already

The Adirondack Tech Talk & Entrepreneurial Meetup on Thursday, September 25 brought a sharp mix of innovators, builders, and curious locals to RiverTrail Beerworks in Saranac Lake, NY. With the brewery’s doors opening at 5:00 PM and conversations flowing by 5:30, the gathering created a relaxed but thoughtful space to

AI use cases for community banking are starting to look a lot less like Silicon Valley wishlists and a lot more like real tools solving gritty, local problems. Picture this: a small-town branch in Iowa, a desktop monitor humming behind the teller counter, the smell of fresh coffee wafting from

Use Cases for AI in Community Banking are shifting fast from idea to real-life tools that actually do the work. Picture a small bank in Ohio. The morning sun hits the teller windows, the printer hums, and a branch manager scans the weekly performance report, already wondering how much time